Annoucement

What’s the cost of risk?

The cost of risk is a multifaceted concept that has significant implications for individuals, organizations, and society as a whole. At its core, the cost of risk is the potential financial or non-financial loss that an entity may incur as a result of an uncertain event or outcome. In this article, we will explore the various dimensions of the cost of risk and its implications for different stakeholders.

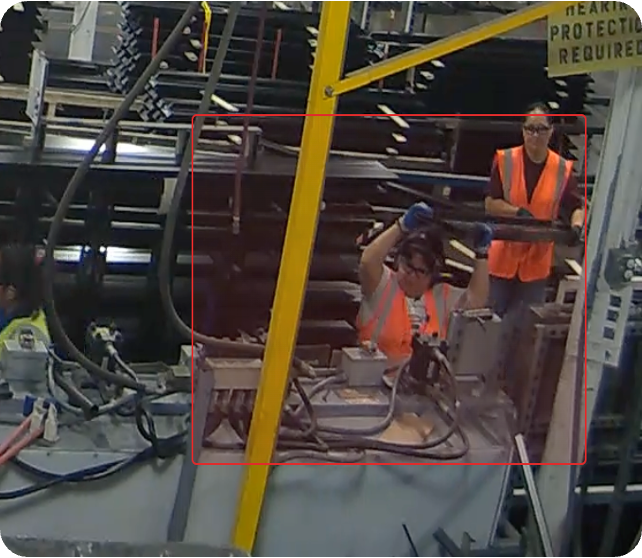

For individuals, the cost of risk is most often associated with the financial impact of unexpected events such as illness, injury, or death. This cost can take many forms, including medical expenses, lost income, and funeral costs. Insurance is one way that individuals can mitigate the financial cost of risk, by transferring the potential loss to an insurance company in exchange for a premium payment. However, insurance is not always available or affordable, and individuals may have to bear the full cost of risk in some circumstances.

Beyond financial loss, the cost of risk can also have non-financial implications for individuals. For example, a serious injury or illness can result in long-term disability, reduced quality of life, or the need for ongoing care. These costs can be difficult to quantify, but they are no less significant for those who experience them.

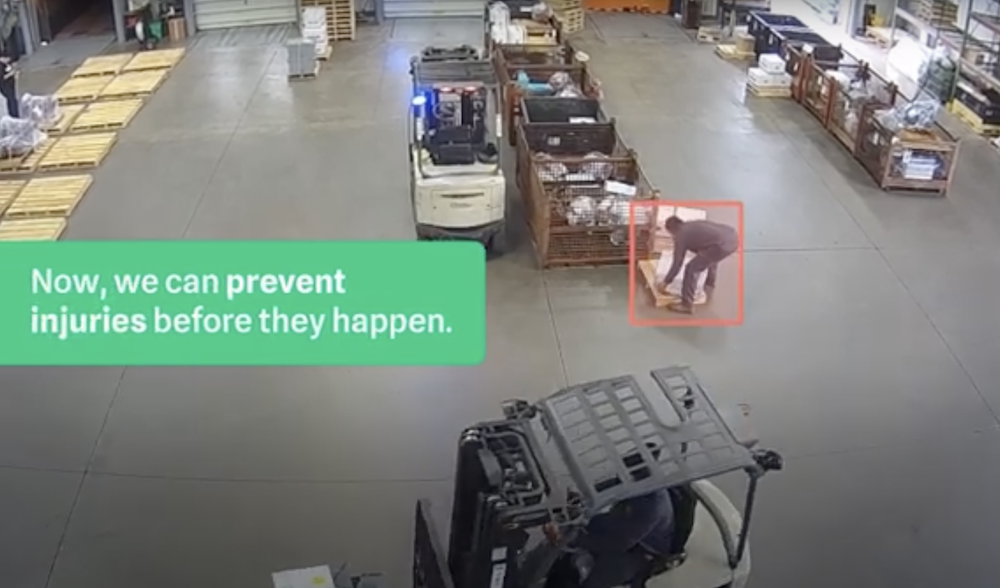

For organizations, the cost of risk can have significant financial and reputational implications. Risks such as data breaches, product recalls, or workplace accidents can result in significant legal and regulatory penalties, as well as damage to brand reputation and customer trust. In some cases, the cost of risk can even threaten the viability of the organization.

Effective risk management is essential for organizations to minimize the cost of risk. This may involve implementing risk mitigation strategies, such as investing in cybersecurity or product safety measures, or transferring risk to insurance or other third-party providers. However, organizations must also balance the cost of risk management against the potential benefits, as investing too heavily in risk management can also be costly.

Finally, the cost of risk also has broader societal implications. When individuals or organizations are unable to bear the full cost of risk, the burden may fall on others, such as taxpayers or insurance policyholders. For example, when a natural disaster occurs, the cost of recovery may be borne by government agencies or insurance companies, which in turn may pass those costs on to policyholders through increased premiums.

Additionally, the cost of risk can exacerbate social and economic inequalities. Individuals or communities who are more vulnerable to risks such as natural disasters or economic downturns may face greater financial and non-financial costs as a result. This can result in a vicious cycle of poverty and disadvantage, as those who are already struggling to make ends meet are further burdened by the cost of risk.

In conclusion, the cost of risk is a complex and multifaceted concept that has significant implications for individuals, organizations, and society as a whole. While financial loss is a key component of the cost of risk, it is not the only factor to consider. Non-financial costs, such as reduced quality of life or damage to brand reputation, can also have significant impacts. Effective risk management is essential for minimizing the cost of risk, but this must be balanced against the potential benefits and broader societal implications. Ultimately, the cost of risk underscores the importance of preparedness, resilience, and a shared sense of responsibility for managing risk in a complex and uncertain world.

More Resources